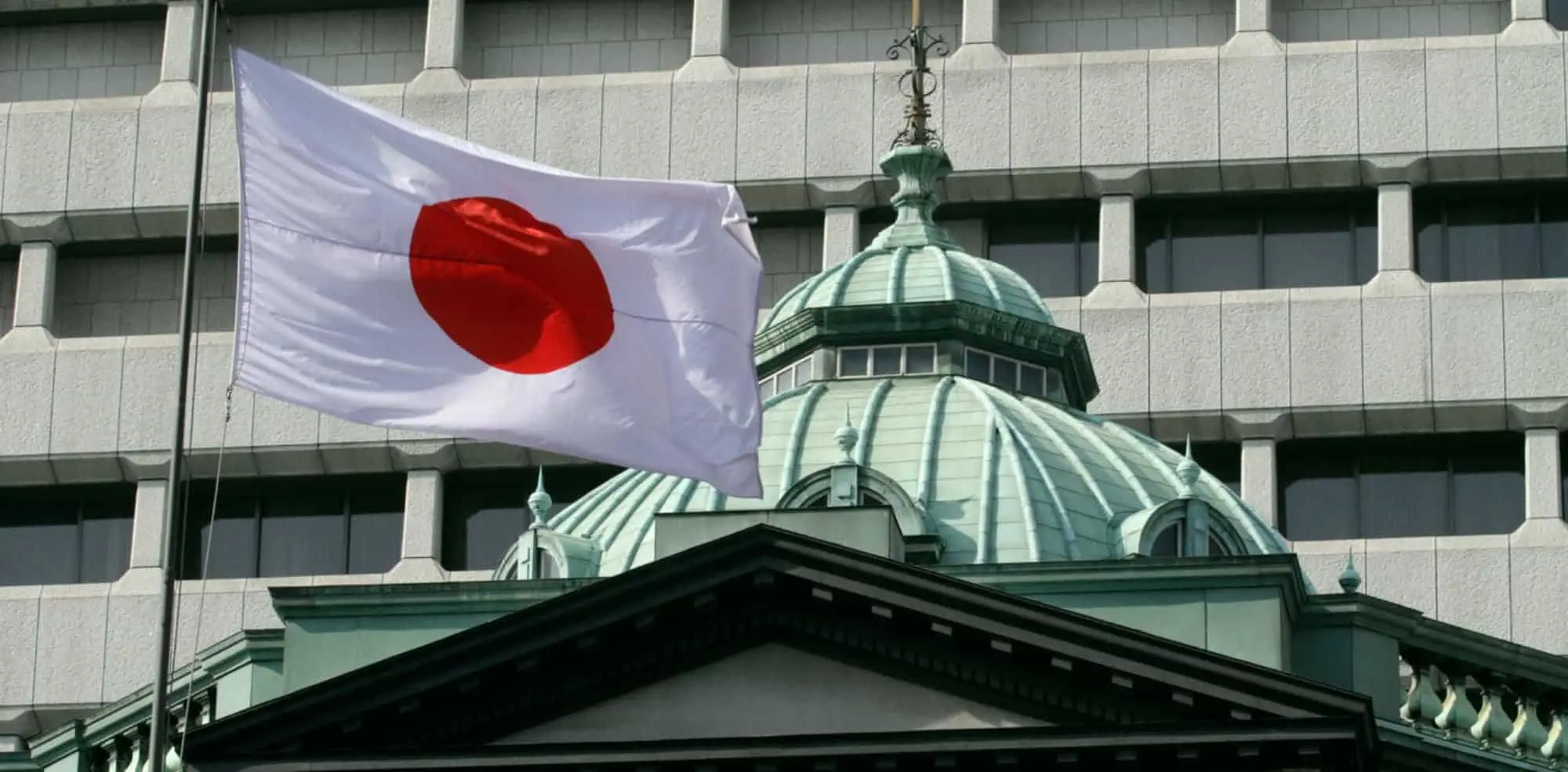

On Saturday, The Bank of Japan’s (BOJ) deputy governor Masayoshi Amamiya expressed his views on central bank-issued digital currencies (CBDC) at a meeting in Nagoya.

Reportedly, he has a quite negative response over CBDC, as he is sceptical about the utilization of it. He claims that “such digital currencies are unlikely to improve the existing monetary systems,” adding further, “the BOJ does not plan to issue digital currencies.”

As per reports, according to some financial experts CBDC is a tool for central banks to manage the economy once interest rates fall to zero. With that, a CBDC would allow central banks to uplift the economy by charging more interest on deposits from individuals and organizations, that will motivate them to spend more money.

Amamiya doubts the theory, explaining that charging interest on central bank-issued currencies would perform only if central banks remove fiat money from the financial system. Or else, people will continue converting digital currencies into cash so that they don’t have to pay interest.

He states, “In order for central banks to overcome the zero lower bound on nominal interest rates, they would need to get rid of cash from society.”

On that, Amamiya proclaims that in Japan absolute elimination of fiat money is “not an option for us as a central bank,” as it is a hugely utilized as a method of payment in the country.

He believes that the switch to bank-issued crypto from the existing sovereign currencies is considered “quite a high hurdle.” Notably, Cryptocurrencies are not stable assets, also correlated to speculative investments.

Here, Amamiya strongly emphasizes that the bank is not intending to create a CBDC that can be widely used by the public for settlement and payment purposes.

Back in April, Amamiya shared also a negative thought by saying, “a state-backed crypto could have a negative impact on the existing financial system.” Though, at that time he was looking for an emerging fintech like crypto in the future.