Over the years, online trading has gained a lot of momentum among people. As each day passes, the number of people using online platforms to trade is also increasing.

The convenience of staying back home and trading at their table or study-room has attracted many to online trading.

What is Online Stock Trading?

Online trading has become a household term these days, determining the act of buying and selling financial products such as stocks through the internet.

Decades ago, people used to trade DMA on a one-on-one basis through their mobile phones. Nowadays, online brokers provide these online platforms to their users, which allow them to carry out their trade on their own and help them make enough money.

These platforms have made stock trading simpler and accessible for many as people can trade their stocks on the go with proper internet connections.

These platforms aren’t just limited to buying and selling stocks but also educating their users by running tutorials in their apps, making them aware of the risks, and helping them understand different financial products in the market.

Benefits of Online Trading

- Now individual traders don’t have to visit financial institutions to open up their trading account and wait for days to get their account started; through these platforms, one can register and start trading within 24 hours.

- Online trading has brought more control in the hands of traders or users as no third party is involved; there is no broker or brokerage charge.

- Users can do real-time monitoring of their stocks at any time of the day, keeping a close check on the stock performance and prices through integrated market charts and historical price levels.

- One aspect that draws people towards online stock trading is a speedy transaction; users can buy and sell stocks with just one click.

Although there are various online trading platforms, very few provide rich user experience and top-notch services. Here are certain ways to choose the right trading platform and get started with your trading.

How to Select a Trading Platform?

Here are the tips to consider before choosing an online trading platform:

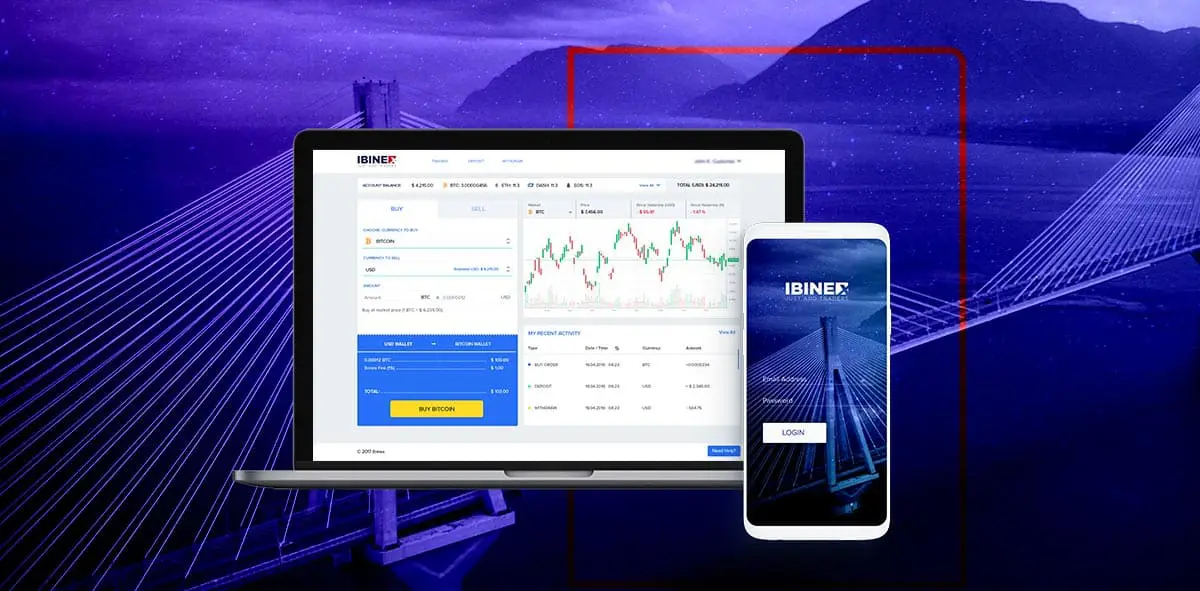

- The online trading platform should be fast with an easy-to-use interface, making it easier for users to conduct quick and spontaneous trading.

- The platform should consist of interactive graphical representation of charts in various forms, such as Line-Char, Bar-chart, Candlestick chart, etc.

- The trading platform should have a high level of security

- Online trading is accessible through phones and PCs. High-level security should be a priority as all your bank and transaction details are stored there, and there is always a risk of a potential hack.

Besides, the trading platform should have a strong trading interface with minimal downtime. Banxso trading platforms offer all the features mentioned above at low commissions with reliable execution. It aims at young investors and offers free stocks, indices, commodities, currencies, and exchange-traded funds. The trading platform allows users to buy and sell various cryptocurrencies, such as Bitcoin, Ethereum, or Cardano.

Not Just Cryptos, Banxso allows its users to purchase fractional shares of Facebook, Amazon, or Netflix.

Along with all the trading options, Banxso’s state-of-the-art trading platform provides educational seminars and webinars on its website; when young traders have any queries or problems, they can opt for a one-on-one consultation with a financial advisor or trading expert. Traders who are already aware of the market functioning will enjoy Banxso’s wide range of investable assets.